Since the COVID-19 pandemic, US cities and workplaces have gradually lifted restrictions. As this occurs, the foreboding impact of the pandemic arrives: economic recession. This financial crisis is seen through rising inflation, unemployment and commodity prices. Moreover, this recession’s detrimental effects are accompanied by the drop of oil prices, ensuing energy crisis and Russo-Ukrainian War. But, let’s examine the depths of recession’s roots and ramifications for both the US and global economies.

ECONOMY

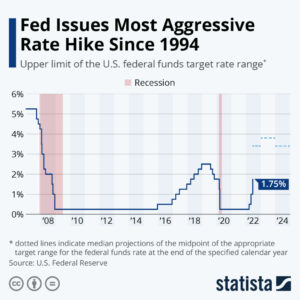

Since the pandemic, the US economy has experienced a violent turbulence. Slowing of supply chains, desperate housing demand, labor shortages, and a winter war ramped inflation at home. In October, US consumer prices rose by 7.7%, which is 5% higher than the Federal Reserve’s target. As a result, the Federal Reserve hiked the interest rate to 4%. Through this action, the Federal Reserve hoped to make access to loans more expensive and limit the demand for houses, cars, and workers.

In addition, there are several visible signs that the US economy might survive the upcoming recession. In October, the US added 261k jobs and average earnings rose by 5%. Also, consumer spending reaches an all-time high, whether it is at casinos or airports. According to the Department of Commerce, US consumer spending rose by 0.6%, which was higher than many economists’ expectations. Earlier this fall, American and Southwest Airlines reported record operating venues. Airbnb reported its highest quarterly revenue at nearly $3 billion due to more bookings and longer stays.

By the end of 2022, the vast majority of economists predict that recession is inevitable. This will force employers to cut jobs, reducing corporate profits drastically in the past and upcoming fiscal quarters. So, there is a high probability that the US economy itself will not be completely battered by the recession. However, the stock market will most likely suffer from the onslaught.

STOCK MARKET

In 2018, Wall Street got a preview of how stocks might be rattled. Despite making initial gains, major stock indexes posted their worst yearly performances since the Great Recession of 2008-09. Nasdaq Composite and Dow Jones plunged 4% and 6% respectively. For the last fiscal quarter (Q4), S&P 500’s and Dow’s stocks fell by 11-14% as Nasdaq dropped 18%. This marked the worst quarterly fall since 2008. The drastic and volatile drop stemmed from investors’ fears of an economic slowdown, potentially dangerous Federal Reserve’s monetary policy, and the escalation of the US-China trade war.

2020 was supposed to be a year of the stock market’s rebounding from 2018. Specifically, the stock market was learning to live with higher interest rates in an emboldened economy. However, as the pandemic worsened, the Federal Reserve used its post-2008 strategy that allowed the stock market to enjoy the conditions that propelled it for a decade. During this time, retail investors started to open up Robinhood accounts, enlarging the developing bubbling of the stock market.

Since the pandemic, large stock indexes like S&P 500 and Nasdaq returned 100+%. However, this year marked the gradual negative fluctuation of stocks. Like 2018, the Fed Reserve started to hike rates, leading to the swift plunging of the market. Also, 2018 witnessed small hikes that sent the stock market reeling, visibly similar to 2022 except for steeper hikes due to inflation.

Currently, the economy’s ability to handle steeper hikes is a question that the stock market cannot answer. This leaves the stock market’s future uncertain as we approach 2023.

BANKS & INDUSTRIES

Now, corporate America is starting to feel the chill of a looming recession. A recent Business Roundtable survey of top US CEOs indicated that hiring and capital investments are slowing down as borrowing costs rise. Many CEOs have issued warnings and intended precautionary actions ahead of this month.

As the Ukraine conflict and inflation persist, the world’s largest investment banks expect slow economic growth in 2023. In response, the US Federal Reserve increased interest rates by 425 points since the rate-hike in March 2022. Morgan Stanley, Goldman Sachs, and other financial service companies are projected to have miniscule gains or declining real GDP rates in 2023. JPMorgan CEO Jamie Dimon warned of a “mild to hard recession” as a dwindling economy and agitating inflation damage consumer spending.

The aviation industry is also impacted through the decline in air travel demand. People will view traveling as discretionary spending. As a result, airlines will raise the price of travel tickets as fuel costs climb. For instance, Scott Kirby, CEO of United Airlines, indicated that “pre-recessionary behavior” is being taken ahead of the holiday season.

For tech giants, income and employment reductions are imminent. Even though the pandemic has benefited many tech companies, the environment for profit is getting more complicated. First, iPhone sales were lower than expected during Apple’s fiscal quarter. However, this did not dim the company’s consumer resiliency. CEO Tim Cook concluded that “demand was strong and better than we anticipated that it would be.” Next, Meta experienced its second consecutive quarter of revenue declines. This occurred due to pressure generated from challenges with Apple’s App Tracking transparency policy and competition with Apple and Tiktok. Also, investors are worried about Meta’s $9.4 billion metaverse program. Finally, both Amazon and Microsoft issued weak holiday forecasts, but their future remains optimistic.

SMALL BUSINESSES

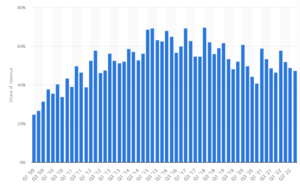

Small businesses (SMBs) are the backbone of the US economy. The behaviors of SMBs will determine the direction of the economy. SMBs compose 99% of all businesses and their employees make up 50% of total employment in the US. Similar to large corporations, small businesses share an uncertain fate in 2023. Most economists predicted a recession as the Federal Reserve raised interest rates. But, predicting a recession’s impacts on small businesses varies from place to place.

According to the US Bureau of Labor, small companies with fewer than 250 employees accounted for nearly 80% of the 10.3 million job openings. However, competition for new hires with larger companies is extremely difficult. Many small firms cannot compete head-to-head on total compensation, including benefits such as retirement plans and health insurance. Confronted with a burdening disadvantage, many store owners promised increasing wages for job applicants and lowered application requirements. This allows stores to allocate time and resources on internal training for new employees. In addition, many SMB owners are planning new marketing initiatives, implementing tech upgrades, and allocating resources to resolve operational issues.

Despite hiring difficulties and the looming inflation, small businesses have an optimistic outlook for 2023. More than 70% of SMBs expect their revenues to increase and 65% were optimistic about their companies’ growth in the economic downturn. Favorable consumer spending and significant company growth will continue to be signs of hope for small businesses in the coming recession. While large enterprises have adopted cost-cutting actions, the majority of SMBs maintained their continued spending course. Overall, this helps the US economy to stay in a relatively stable position, a comforting relief for the anxious American public.

LAYOFFS

Along with the fear running deep among CEOs and SMB owners, employees also fear the looming recession. As predicted, various companies of all sizes started to reduce their workforce. According to consulting firm Robert Half, 46% of professionals are already looking for a new job in anticipation of the recession, a 41% increase in a rapid six-month period.

Bracing for potential recession, the tech industry is laying off workers at an alarming rate. Despite solid job growth and record-high earnings, tech giants have implemented hiring freezes and workforce reductions as the Federal Reserve elevated interest rates to combat inflation. Applications for US unemployment benefits have declined sharply, while job growth in October remained solid as 261k jobs were added. For instance, Apple is slowing down its iPhone 14 production as consumer spending declines and China enforces strict COVID lockdowns. Other massive tech companies such as Twitter and Lyft respectively suffered 50% and 13% employment losses.

The media industry is also heavily affected as hundreds were either laid off or left by choice. Buzzfeed, one of the latest media companies to reduce its workforce, stated that it was attempting to “weather the economic turndown,” which it projects will extend into 2023. In addition, 55-58% of those who work for large companies for 2-4 years have indicated that they are seeking alternative employment.

LABOR SHORTAGE

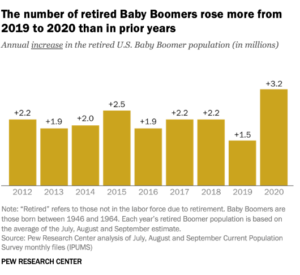

While tech layoffs dominate the headlines, many Americans are feeling confident they will not lose their jobs. The reason for this confidence is that companies are struggling to find workers, proven through 10 million job openings in October 2022 alone. There are two primary factors driving labor shortage: aging population and declining immigration.

According to the Census Bureau data, the US population experienced its slowest population growth in 2021. While some stagnation occurred due to the pandemic, this trend is expected to continue for the next decade. By 2030, all baby boomers will be 65 and ⅕ of Americans will be in retirement age. Later, by 2034, older adults will outnumber children for the 1st time in US history. While lower fertility rates have driven more women into the workforce, the cost of raising children has also deterred many from raising families.

Accompanied with fewer children, the diminishing of immigration to the US also exacerbates the labor shortage problem. Since 2016, net international migration to the US has fallen 75%. In a span of five years, the number of immigrants to the US went from 1 million to 247,000. According to a study by Peri and Reem Zaiour, if immigration continued to increase, the US would’ve had millions more workers in desperately needed areas such as healthcare and hospitality. A steady decline in the workforce could also create problems for care of the rising elderly population, indicating less tax revenue to fund Social Security and other government aid programs.

Even though the recession might seem like a temporary issue, labor shortage is also a looming and dangerous presence for the US economy. Many experts concluded that slow growth will likely have significant repercussions on the national mood/enthusiasm and economic competition with rivals like China.

IMPACTS ON EUROPE

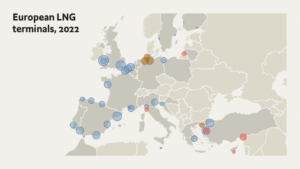

Currently, the Euro zone is expected to plunge into a deep recession. Following Russia’s declaration of war on Ukraine, the 19-member zone imposed heavy sanctions on Moscow and cut off all Russian gas imports. This resulted in member nations scrambling to import liquefied natural gas from other nations in Africa and the Middle East. Despite showing an initial strong growth (even better than the US), European consumer confidence dropped to an all-time low in September 2022. Simultaneously, natural gas prices remain elevated and capital expenditures slump. Even if Europe survives the recession in 2023’s Q1 (Jan-Mar), recovery will be difficult.

IMPACTS ON ASIA

Earlier this month, Asian stock markets experienced sharp declines. As a result, Beijing announced that it promised to stimulate domestic consumption and the real estate market in order to stabilize its economy. Simultaneously, thousands of Chinese civilians protest the government for its strict zero-covid policies.

In addition, Chinese government advisors recommend that 2023 growth targets range from 4.5-5.5%, an overarching target well above the current growth of the struggling economy. As a result, Chinese stocks plummeted rapidly. For instance, the Shanghai Composite Index lost 1.3%, while many other Asian stock indexes such as Japan’s Nikkei 225 and Australia’s S&P/ASX 200 experienced significant drops as well.

Recently, due to the reverberating impacts of the protests, the Chinese government decided to reverse its policies. Instead, Beijing announced that it would soon allow its civilians to travel abroad, leading to the US and many others to augment covid prevention measures. Simultaneously, the country continues to suffer from COVID-19 outbreaks affecting hundreds of millions of citizens.

CONCLUSION

According to 70% of economists, the US will most likely enter a “mild” recession. In November 2022, JPMorgan predicted to contract by 0.5% in the fourth quarter of 2023 (Oct-Dec). As a result, the US is projected to lose over a million jobs by mid-2024. Even though international crises from Ukraine to decline in trade, the US is expected to survive this recession like 2009.

The world’s largest economy will “stick a soft landing” as inflation and unemployment give way. According to CNN Business analyst Mark Zandi, Americans will uncomfortably struggle in the first few months of 2023, but they will “thread the needle.” Recently, real personal income rose again with a predicted 3+% growth over 2023. Even though labor shortage is still an existential threat, the pandemic has subsided and unemployment benefits have normalized. Moreover, as for the job openings, the job-workers gap (total labor-total labor supply) has dropped significantly from 6 to 4 million.

Despite the troubling threats looming, the resilient US economy is expected to gradually recover from the pandemic and stabilize in the future. Stay tuned to The Roundup for more economic news and its effects on our community!