In 2008, Tesla emerges from the dust, releasing the world’s first all-electric sedan. The sporadic and dying EV industry sees a beaming light. In late 2008, Elon Musk becomes CEO of Tesla, and further establishes Tesla as both a leader, and maverick of the industry. Musk coordinates the development of a self-driving car, the closest we have seen to fully autonomous, and investors line up as the company sees growing profits. In 2023, the Tesla Model Y becomes the most sold car of any type in the world. For years, Tesla was hailed the Apple of the auto industry.

Lately however, Tesla has come to a crashing halt. The company has struggled through a swamp of mediocre earnings reports, summed up by the latest Q1 report, in which the company saw a 32% decrease in sales from Q4 2024, not to mention other disappointments in key metrics like EPS.

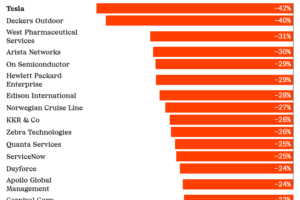

Tesla stock lost 53.48% from December, 2024 highs, and 40.11% as of April 21st, 2025, solidifying its position as one of the worst performing stocks in the S&P 500 during that period. These declining statistics make investors question if the untouchable EV giant is still that. So what prompted the decline? What pressures do Tesla face? And, how can Tesla succeed going forward?

The Financial and Stock Decline

While the recent earnings flops tangibly display the motive behind the depression, we need to look deeper. In my opinion, Tesla didn’t just miss numbers, it lost control of its story and focus.

Problem 1: Failed Promises

Tesla’s brand centers itself around being a futuristic, cutting-edge company. The company launched model S when EVs were a joke, and scaled model 3 production despite doubts. Because of this rapid innovation, the market rewarded Tesla with overpriced valuations based upon its future potential. But lately, Tesla seems to be running over its own feet.

In 2019, Tesla unveils a concept for the space-age, Cybertruck, set to mass produce in 2021. Tesla Cybertrucks did not mass produce until early 2025, and the first delivery did not take place until November 30, 2024, a massive disappointment to consumers and investors.

Also in 2019, during Tesla Autonomy Day, Elon Musk makes a series of claims about FSD, one of which being that in the “next year for sure, [Tesla] will have over a million Robotaxis on the road,” even making claims that it could be an income source for Tesla owners with inactive cars. This bold statement, of course, raised investor hopes and expectations. 6 years later, we have yet to see this project fully executed, and at that, FSD only sees itself stuck in beta-stages, fighting a war against the DAWN project which seeks to take it down.

Conclusion

Through these examples and more, Tesla now presents itself as something of a Boy Who Cried Wolf company, one whose promises are no longer taken serious by investors, but a series of outcries attempting to keep investors hooked.

At that, Tesla freely uses these prospects as a distraction rather than a serious proposal or step toward innovation. At every disappointing earnings call, we see Elon quickly pivot from the missed deliveries, or lackluster EPS, to an unrealistic claim about Optimus execution and utilization, or yet another trailing assurance about the long-promised roadster. These mentions often lack real dates and strict plans, but serve just to keep the hype afloat.

Problem 2: CEO Controversy

I’ll keep this point short, though it has and will have quite a consequence on the company’s sales. On his inauguration on January 20th, 2025, Donald Trump established the Department of Government Efficiency, to which Musk quickly involved himself. His controversial actions and power within the Department rapidly caused mass outrage, and a large portion of Tesla’s market boycotted the company. Others would not buy a new Tesla in fear of being a target of the outrage.

These actions as well his frequent tweets, offensive to some, result in unpredictable, staggered sales, dependent on the peoples’ current outlook on Musk. This leads many to consider him a burden to the company, and lose faith in the company because of it.

Pressures:

Tesla has long been the undisputed leader of the EV industry, even a monopoly to some extent. Their autonomous driving was unlike anything ever seen, and with their colossal data monopolization, it seemed irreplicable.

While Tesla continues to stand tall in the face of competitors, they no longer hold their dominance. I will talk about two different threats to the Tesla brand, Slate Auto and Waymo.

Slate, the “Anti-Tesla”

Slate Auto, a Michigan-based startup founded in 2022, emerged into the public spotlight in April 2025 with a bold announcement: a fully electric pickup truck priced under $27,500, or closer to $20,000 with federal EV tax credits applied. That’s less than half the industry average of $59,205, and nearly unprecedented in the current EV market. The truck is expected to deliver between 150 and 240 miles per charge and can recharge from 10% to 80% in just 30 minutes. The truck embodies a minimalistic look and feel, eliminating permanent accessories or infotainment screens, subject to being outdated, and instead, allows for constant technology updates.

This is not to mention the remarkable personalization, available to see on their website.

Slate auto is also heavily backed by Jeff Bezos, the same Jeff Bezos that manifested an amazing success for Rivian, the second largest EV company in the United States. And with sufficient and reliable supply chains, and a practical approach, the company sees my confidence in execution. Even if Slate manages to fulfill half of their promises, it will be one of the biggest innovations in the EV industry, and auto industry as a whole.

Slate isn’t trying to beat Tesla in its own game, its changing the game. Slate’s truck appeals to long-term consumers, rather than the Cybertruck’s short term niche. Slate focuses on practicality rather than the cool but unreliable approaches that Tesla takes.

Waymo Autonomous Driving

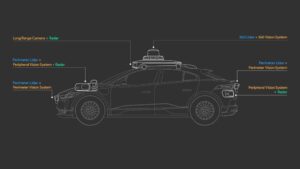

Waymo, founded in 2009, is an Alphabet (Google) owned company that develops and deploys fully autonomous driving technology. Waymo’s latest fifth-generation sensor suite, deployed using a Jaguar, uses a 360-degree lidar, three perimeter lidars, three radars, and many video cameras. These specs create a 360-degree view of the surrounding area, allowing the car to drive even when its foggy, sunny, or pouring rain. The cameras also automatically clean themselves when dirty.

The lidar suite produces a high-resolution, 360-degree field of view with a range of 1000ft. The camera can detect stop signs from 1600ft away. In addition, Waymo uses a mapping system, where routes are carefully mapped out, so the car can always recognize its position. This technology understandably took a very long time to create, and Waymo is finally showing itself.

Tesla on the other hand, has been speeding through the development stages of its own autonomous driving technology, chasing the unrealistic expectations it sets for itself. Tesla autonomous driving utilizes multiple cameras around the car to constantly generate a 2d image of its surroundings. This feed constantly runs through massive neural networks, with the philosophy of acting like a human brain, interpreting sight.

While this method is efficient and cost-effective, it presents many safety concerns that are difficult to fix. For example, Tesla cars struggle to notice school zones, and sometimes stop-signs, as well as other crucial street signage. Waymo however, recognizes these signals through lidar. This is not to downplay Tesla’s technology, for it functions with near-perfect accuracy in most situations, but until it becomes perfect, society will not accept it. And the fast route Tesla took to develop this technology will ultimately be a formidable wall against the goal of perfection.

Effect

Already, Waymo proves its rising dominance over Tesla with their active robotaxis in Phoenix, Los Angeles, Austin, and San Francisco, planning to expand to Atlanta and Miami in the near future. Tesla robotaxis on the other hand are still a hazy vision. Additional to robotaxis, Waymo plans to expand to personal cars through their recent partnership with Toyota. Waymo’s strategic partnerships with companies like Toyota allow for a collaborative effort, set to outpace the one-man-band that is Tesla.

4 Steps for a Better Future

So, I have painstakingly laid out the causes of the decline, and the pressures Tesla face from competition. Now, we must look to the solution, the solution that will bring Tesla back to supremacy.

Step 1: Stabilize Governance

Step 1 involves Tesla incorporating a COO, or co-CEO as a reliable alternative to Elon Musk. This person will become the public face of Tesla, like Tim Cook was under Steve Jobs. The leader must speak during earnings calls, calm markets, and guide product roadmaps. This will decorrelate the company’s performance from the people’s opinion on Musk, and bring stability. I am not at all suggesting removing or demoting Elon Musk; His ideas and executions are obviously crucial to Tesla’s success, and I think removing extra tasks will help him focus on his strengths.

Step 2: Rebuild Trust Through Execution

Step 2 involves Tesla straying from unreliable “moonshots,” and bringing investors and consumers delivery. Tesla must set hard, deadlines, establishing itself as an overperformer. The company must deliver the long-promised roadster, transition FSD from beta to stable across a whole city or fleet, and launch Optimus only when a fully-functioning prototype does something more than a demo-dance, all by a realistic deadline. Sure, Tesla stock will decline and correct to reasonable levels, but credibility will allow for healthy, stable growth rather than a cardiac monitor-looking graph. Underpromise, overdeliver.

Step 3: Become the Platform

Step 3 involves establishing strong business partnerships, and succeeding by enabling others. Tesla should aggressively license their technology, such as battery tech or charging software, and collaborate with companies like Toyota and Hyundai on standards. This step could even involve opening Tesla’s FSD platform. By expanding Tesla’s technology, you create an industry ecosystem, entirely reliant on Tesla. Tesla then has all the power over its competitors; They can either continue buying from Tesla, or start from square one.

Step 4: Broaden Product Line

This step is more recreational than the others, but still could significantly help in brand expansion. Step 4 involves building new models other than the S3XY and Cybertruck lineup. I suggest the building of a large SUV model with a GVWR (Gross Vehicle Weight Rating) of over 6000 pounds. Similar to the Range Rover, Section 179 Deduction would allow the vehicle to be written off as a business expense, to the consumer’s tax benefit. Also, a large SUV would be an appealing change from the strictly small SUV and sedan lineup.

In Conclusion

Tesla has proven itself quite the basket case lately. The company has faced internal challenges, as in investor dissatisfaction and financial decay, and external pressures from rising competitors. This disruption should be Tesla’s wake up call, to step up and take action. Despite Tesla finding itself stuck in a rut, there exists a way to reestablish its values and undoubtable dominance. By expanding its significance, rebuilding investor trust, and stabilizing the company, Tesla can become the force it once was.

Stay tuned to the Roundup for more Viewpoint coverage!