Warren Buffett, born August 30, 1930, is regarded as one of the best investors in modern history. He has obtained a hefty $140 billion throughout his career and is still investing at the ripe age of 94. Although most people just know him as an investor, he is also a renowned philanthropist and teacher.

Early Life

In The Warren Buffett Philosophy of Investment, it states Buffett had thought about making money since before he was born. As a child, he showed a huge interest in business and investing, buying his first stock at the age of 11. He was a straight-A student, graduating high school at 16, and enrolling in the prestigious Wharton School of Finance. He later received his Bachelor’s Degree in Business Administration from the University of Nebraska–Lincoln, and his Master of Science in Economics from Columbia. While at Colombia, he studied under Benjamin Graham, author of The Intelligent Investor and the “father of value investing.” Graham’s teachings were vital to the creation of Buffett’s investment principles, and set him on a path to become the greatest investor of all time.

The Creation of Berkshire Hathaway

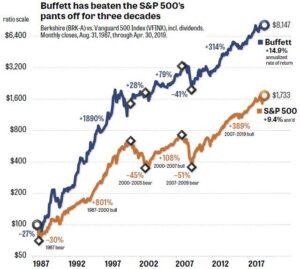

After graduating, Buffet took jobs in investment firms including his mentor’s, Graham-Newman, until eventually in 1956, he decided to start his own investment firm, Buffett Partnership LTD, delivering amazing returns for investors. A few years later, he began investing in an undervalued American textile company, and by 1965 he gained full ownership of the company, known as Berkshire Hathaway. Over time, Buffett shifted the focus of the company away from textiles and towards investments due to the its resources. Berkshire Hathaway has outperformed the market, often exceeding a yearly 20% yearly return. To put it into perspective, over 90% of finance professionals cannot beat the market over a 20-year period. And through Berkshire Hathaway, Buffett not only beat the market, but he beat it by a huge margin!

The Buffettology

Although Buffett often speaks of the simple nature of his investment principles, they are far from easy in practice. Buffett’s principles can be simplified into four main ideas.

-

In-Depth Study of the Business

Along with business, Buffett was known to have had a keen interest in history. He would collect financial reports dating back as far as a financial report could, and studied them. He advocated for a rigorous and extensive research because in reality, it’s a business your investing in, not a line that just happens to go up or down. This rigorous study allows him to be reassured and confident in the business he picks.

-

Long-Term Goals

“My favorite time frame for holding a stock is forever” and “we don’t sell, we have an entrance strategy, but we have no exit strategy” are perfect examples of how Buffett views the time frame of an investment. He often recites the idea that the stock market is irrational and unpredictable over shorter periods of time, and the only real indicator of how a company is doing is its stock over a decade-long period or longer.

-

Investing Within the Circle of Competence

Buffett advises against investing in companies that are not in your circle of competence. He is a firm believer that the best way to decrease risk is not diversification (he actually is against diversification), but using your deep understanding of certain companies and sectors to pick an investment below its intrinsic value. When you try to pick a stock that is not in your circle of competence, it’s very likely you won’t make a smart investment.

-

Having a Robust and Independent Opinion

Finally, having an opinion that is not developed because of emotion or due to the masses is very important to Buffett. Often times, people invest in a company just because of the hype behind it. Buffett preforms contrary to the most of investors, where his favorite time to invest is during mass panic.

What to Take Away

If you want to be a smart investor and even beat the market, a great place to start is by looking at famous investors like Warren Buffett, and modeling your strategies off of theirs. Warren Buffett is the epitome of a value investor, so if you have the desire to grow your wealth substantially over a long period of time, studying people like him, Peter Lynch, and Benjamin Graham could be very beneficial. However, also realize that although “history often rhymes,” it’s not always exactly similar, so you must also create your own principles and see what works for you.

Tune into The Roundup for more viewpoint articles!