Introduction to the GameStop Saga

Something fairly unexpected happened on Wall Street in January 2021, it changed the conventional balance that had been maintained in the stock market. A diverse group of retail investors, many of them young and using commission-free trading apps like Robinhood, pulled off something that seemed impossible: they sent the stock price of GameStop, a struggling video game retailer on the brink of disappearing, soaring to incredible heights. What started as a wild idea on a Reddit forum called r/WallStreetBets quickly gained global attention, sparking a financial rebellion that rattled the very core of the financial world.

What kicked off as a casual talk between retail traders online soon gained momentum and developed into a campaign that profoundly disrupted Wall Street. Retail investors banded together, deploying social media and trading platforms to take advantage of weaknesses in strategies from powerful hedge funds. With GameStop stock on its way to a massive rise, some hedge funds that had large short positions were in serious trouble, having lost billions. The scale and speed of this phenomenon left analysts, financial institutions, and regulators scrambling to comprehend its implications.

But the GameStop saga wasn’t just about stock prices. At its core, it was a battle over power and influence. It became a symbol of defiance, a moment when ordinary people-armed with determination, creativity, and the tools of modern technology-challenged the traditional dominance of Wall Street elites. To many, this was overdue payback that showcased the inequalities of a financial system that sometimes appeared slanted toward institutional investors at the expense of the common trader.

Beyond the immediate financial consequences, the GameStop saga provoked serious and fundamental questions about equity and transparency in the stock market. It underlined the increasing integration of technology in modern investing. The event also sparked intense debates about the responsibilities of trading platforms, the ethics and effectiveness of short selling, and the need for regulatory reform to adapt to this new era of investing.

The GameStop phenomenon is not a single event, it is rather a tipping point that has forced hedge funds, financial institutions, regulators, and the regular investor to reassess how markets work in a world where social media and technology make individuals more powerful than ever.

How Reddit and Retail Investors Fueled GameStop’s Stock to Rise

The GameStop phenomenon was catalyzed through a single Reddit forum: r/WallStreetBets. It’s an online community full of memes, humor, and unconventional investment ideas. By late 2020, some members of that forum began paying close attention to GameStop, which has been struggling for years.

What they noticed was large: hedge funds were seriously short selling GameStop stock. One of the strategies that investors undertake involves betting against the success of a company, known as short selling. The way it works is that the investor borrows shares in stock, sells them at the prevailing price, then hopes the price drops. If this happens, he may purchase the shares at their reduced price, return them, and pocket the difference as profit. This means that if the price of the stock rises, the short sellers will have an obligation to purchase the same shares at a higher price and at the cost of huge losses.

In walked the r/WallStreetBets crowd and retail investors, searching for an opportunity. It worked like this, they knew that when enough people purchased GameStop’s stock, it would eventually force a price increase in the security and create something known as a “short squeeze.” A short squeeze occurs when short sellers must purchase stock back at higher prices to hedge against their previous trades, serving to push prices upwards even farther.

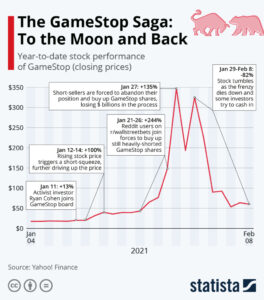

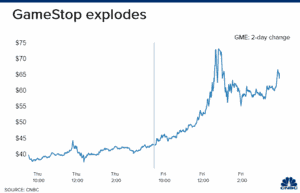

This was a plan that required collective action, and social media made it possible. The more who joined in, the higher GameStop’s stock price soared. In January 2021, it surged from less than $20 per share to a peak of $483. For many on Reddit, this wasn’t about making money, inversely it was about proving ordinary people could take on Wall Street at its own game.

In no time, the movement went viral with hashtags like #HoldTheLine trending on Twitter. This was simply a call for investors, at their own risk, to keep holding their GameStop shares as a way of keeping the heat on hedge funds. It became a symbol of defiance, a small way for the everyday person to challenge a system that favored the few.

Hedge Funds’ Reaction to the Chaos

The GameStop rally was, for hedge funds, something of a nightmare. One of the worst losses was the well-known hedge fund Melvin Capital, which had opened a large short position on GameStop. As the stock surged, the firm lost billions, virtually in the blink of an eye. It sustained such unprecedented losses that it had to seek an injection of $2.75 billion from the hedge funds Citadel and Point72.

Another high profile and major loss was Citron Research, a hedge fund that released reports aimed at encouraging short selling. It had been extremely vocal about its bearish outlook for GameStop, once even calling for the stock to drop as low as $20. Instead, the stock soared, and the firm lost millions. In the aftermath, Citron announced it would no longer publish reports promoting short selling, a significant change of course for the company.

But it was not just the case of Melvin Capital and Citron Research; the other hedge funds also took damage. The surprise attack in volatility sent shockwaves around the world of finance, making hedge funds rethink their strategies. Companies previously inclined toward short selling started being cautious, realizing that for the first time, retail investors were able to unite and move against them.

The broader implications of the GameStop rally extended well beyond whether one or two hedge funds were taken down. It exposed weaknesses in the financial system for firms reliant on short selling. The comforting assumption that retail investors were too small or disorganized to pose a serious threat was quickly abolished. The hedge funds realized that social media platforms, like Reddit, can serve as powerful tools for collective action, amplifying voices for the ordinary investors.

The Role of Robinhood and the Controversy

The controversies did not stop at hedge funds. Trading platforms such as that of Robinhood were also under the microscope. First, Robinhood had grown popular for its ease of use and zero-fee trading; thus, it was the first choice of retail investors. On January 28, 2021, it took a very unpopular turn by restricting trading on GameStop and other highly volatile securities.

Robinhood banned users from buying the stocks, but they could still sell them. The move sent the online Twitter and Reddit forums into a furor, where small investors accused Robinhood of helping the hedge funds shut ordinary people out of the market. #RobinhoodScandal began trending, and lawmakers demanded answers.

For its part, Robinhood said the restrictions were needed to comply with the regulations and keep up liquidity. In its defense, the firm claimed that the unprecedented trading volume had placed them under enormous financial obligations, which forced them to take such action in order to protect its operations. To many investors, however, the damage was already done.

The controversy created a sharp divide between Wall Street and everyday investors. Armed with the financial means to ride through the storm, hedge funds were better positioned than retail investors, who felt abandoned by the very platforms on which they had relied. The incident broached some critical questions about the fairness of the financial system and whether retail investors were being accorded a place at the table with institutional players.

Lessons Learned from GameStop

The GameStop saga was a massive financial lesson for everyone concerned. It questioned the structure of Wall Street, asking about the future of investment in these growing digital and connected worlds. Here are some key takeaways from the GameStop phenomenon. The GameStop incident proved that retail investors can make quite an impact in the stock market when combined. What began in the group r/WallStreetBets transformed into a movement that showed that social media and social investing apps like Robinhood could democratize or give an inch to the little guy to take on the might of Wall Street. It had started to show that retail investors no longer can be shrugged off and may move the market in ways up until this moment unimaginable as the balance of power shifts.

- Short Selling is Risky

The GameStop short squeeze taught hedge funds a lesson in the dangers of short selling. Companies like Melvin Capital had heavily shorted the stock of GameStop, expecting it to fall, but they had underestimated a horde of retail investors. As it surged, the hedge funds lost billions and had to beg for bailouts. It underscored the dangers of short selling, where market conditions could be unexpectedly moved by the masses through small investors, incurring great losses for those who miscalculated the risks involved.

2. The Market Needs Better Rules

GameStop called into serious question the fairness of the stock market. These restrictions imposed by Robinhood include limiting the purchases of GameStop during the squeeze. Angry retail investors felt that big players were being protected. While Robinhood explained that this was done in order to meet their regulatory requirements, this whole issue opened up debate on if trading platforms should be in such a position where they could restrict trades in such moments of volatility. This was a sign that more regulation is needed in the market, with the rules being clearer and offering retail investors protection during such volatility.

3. Investing is Emotional

To many investors in GameStop, the rally wasn’t about the money, it was about making a statement and a movement against the powerful hedge funds. The same collective energy that drove it up has caused massive losses for those buying at the peak. The GameStop saga did show that investment decisions could be driven by emotions like frustration and defiance, and this can lead to periods of market volatility. It reinforces a decision to invest based on information and strategy.

Retail Investors: a Win, or Market Manipulation?

The GameStop phenomenon quickly set off a heated debate over whether it was a victory for the little guy or a form of market manipulation.

To the retail investors, it felt like a win. It showed that ordinary people could take on Wall Street and be heard. The rally gave a sense of empowerment to those who felt excluded from the financial system.

However, some people say that the coordination on Reddit to drive up GameStop’s stock counted as market manipulation. It had some serious consequences, such as many unsophisticated investors jumping in at the peak and losing money when the stock eventually crashed.

Volatility at that instance increased due to further turbulence in the wider market, with an understanding that such occurrences will raise serious questions about the long-term implications. If, indeed, retail investors continue the targeting of heavily shorted stocks going ahead, further market instability may be provoked that can harm small investors together with the big ones.

Conclusion

The GameStop saga wasn’t a moment in financial history, it was a turning point. Retail investors proved that they have the tools and power to challenge Wall Street, forcing hedge funds and regulators to pay attention. It has been a movement showing how dynamics in the stock market are changing, where ordinary people now can make a great difference and equalize the playing field in ways unimaginable before.

The GameStop incident highlighted the risks of impulsive investing and insufficient market oversight. Sharp questions have come into focus, including issues of fairness in the financial system and technology’s role in shaping modern investing. The restrictions to trading, the volatility of this stock price, and even the role of social media all underline the complexity of today’s financial environment and markets.

But as the financial world digests the lessons of GameStop, one thing is certain, investing will never be the same again. The event was a forceful reminder that the stock market is not all about numbers and trends but people and their emotions. The GameStop saga has left an indelible mark on the financial world, one that will continue influencing how markets function in times to come.