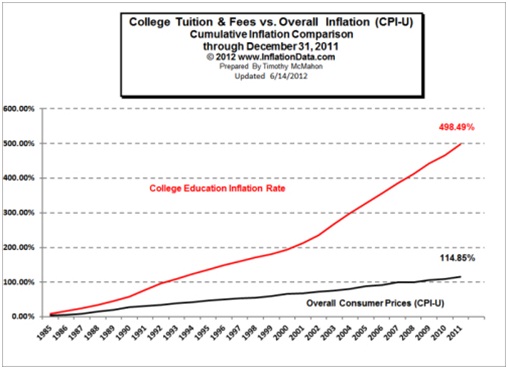

College is not just expensive; it is ridiculously expensive. The price of attending college, particularly four-year private institutions (with emphasis on the elite schools like Harvard, Princeton, Yale and so on) and out-of-state public institutions, is outpacing both the average American family’s income and inflation. In fact, Gordon Wadsworth, President of Financial Aid Information Services at Moody Publishers, points out the following: “…If the cost of college tuition was $10,000 in 1986, it would now cost the same student over $21,500 if education had increased as much as the average inflation rate but instead education is $59,800 or over 2 ½ times the inflation rate.” And to put things in further perspective, InflationData.com’s Timothy McMahon’s chart depicts the college education inflation rate as having risen nearly 500% since 1985.

Indeed, the price of college has also even outpaced healthcare costs and the consumer price index (CPI), according to author Blake Boles,

This begs the following questions: Is college even worth it and why has the price risen so exponentially? The latter, unfortunately, is topic for another debate, though we can certainly point to the ample ability of federal loans and a significant increase in both total university expenses and administrative expenses. The former, however, is the spotlight of this discussion.

The Case Against College

Some people even ardently believe that college is not worth the time, energy, effort, or money. For instance, John McWhorter, a man who describes himself as a high school dropout and is a senior fellow at the Manhattan Institute, wrote the following opinion piece in the New York Sun on December 21, 2006.

“After that [10th Grade], going on to colleges and universities would be one of several choices available. Another choice, equally typical and just as well-funded, would be vocational training. This idea would hardly surprise our great-grandparents. Before World War II, fewer than half of students went beyond the ninth-grade. The concept of a four-year college education as a rite of passage to middle-class adulthood only developed in the wake of the GI Bill. It has become a waste of resources, both monetary and personal.

I see nothing disturbing in an alternate universe where most students of what we now think of as freshman age are, instead, out in the world learning to ply a trade, be it in an office, workshop, or conservatory. Instead, they spend six years after 10th-grade gamely tolerating several dozen courses, most with only the vaguest relationship to the jobs they will seek — or who they will be as people.”

McWhorter does, indeed, make a valid an interesting point as the Bureau of Labor Statistics notes that a Bachelor’s degree simply isn’t necessary for certain jobs. According to the New York Times via the Bureau of Labor Statistics, only seven of the 30 jobs projected to grow at the fastest rate over the next decade in the United States typically require a bachelor’s degree. Additionally, only two of the ten growing job categories require attending college and receiving a degree. Those who want to be an accountant will need a bachelor’s degree in accounting and postsecondary teachers will need to earn a doctoral degree. The biggest and fastest-growing of the ten categories – home health aides, customers service representatives, registered nurses and more – do not require a bachelor’s degree.

Jacques Steinberg, blogger of The Choice of the New York Times, wrote on May 15, 2010: “Professor Vedder (founder of the Center for College Affordability and Productivity, a research nonprofit in Washington likes to ask why 15 percent of mail carriers have bachelor’s degrees, according to a 1999 federal study.”

A post in the Huffington Post by Harry Bradford, Business Editorial Assistant at The Huffington Post, also highlights 10 jobs that don’t require a bachelor degree, including occupational therapy assistants, physical therapist aides, reinforcing iron and rebar workers, brickmasons, blockmasons, stonemasons and tilers to name a few.

Khan Academy, Coursera, Open Courseware, Peer2Peer University, YouTube, Academic Earth, Udacity, and even the up-and-coming Minerva Project which aims to be the “first elite American university to be launched in more than a century” all have resources readily available to students. These websites have a number of advantages including being able to establish your own pace, rewind lecture videos and connectivity to plenty upon plenty of students.

On the other hand, these websites frequently offer an “underwhelming, ineffectual approximation of its on-campus sibling — defined by micro-correspondence courses that are supplemental to the classroom experience, rather than a viable alternative,” as TechCrunch writer Rip Empson described them in an article on Coursera.

The Case For College

As enticing as it may seem for students to skip college altogether, there are plenty of statistics, numbers and other miscellaneous facts that demonstrate the generous benefits of graduating from college – or at least attending some college.

In a 2012 report on college pricing created by the College Board (creators of the standardized SAT/ACT tests), those who have only a high school diploma have an median family income of $48,460 whereas those with a bachelor’s degree or higher have an median family income of $100,096, according to the U.S. Census Bureau. The report also shows the following median family incomes: Less than high school: $30,103; Some college experience: $57,005; and Associate Degree: $66,252.

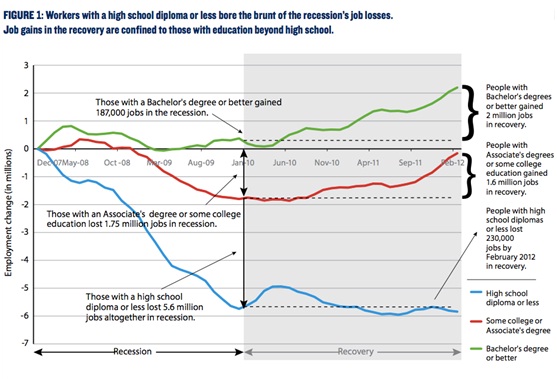

An August 15, 2012 report by Georgetown University’s Public Policy Institute Center on Education and the Workforce likewise conveys the benefits of having a college degree in the Great Recession. The report is titled: “The College Advantage: Weathering the Economic Storm.” The data ends in February 2012.

In the report, for example, the Institute notes that nearly four out of five jobs lost as a result of the Great Recession were held by those with no formal education beyond high school. The graph below (from the report) does a nice job of illustrating that:

Georgetown’s report also notes that “people with a Bachelor’s degree or better have experienced a net increase of 2.2 million jobs over their prerecession levels.” While those with no college diploma and those who had received an Associate’s degree still had a net loss compared to prerecession levels, individuals holding a Bachelor’s degree or higher have seen a net gain. Or, put another way: “Those with a high school diploma or less need 5.8 million more jobs to reach their prerecession employment level, while workers with a Bachelor’s degree or better have 2.2 million jobs over their prerecession level.

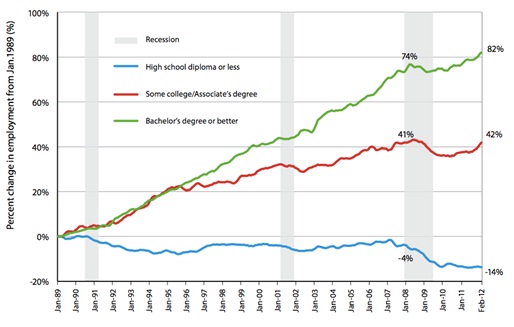

A more interesting trend is that the number of hired applicants who have a bachelor’s degree or better has been steadily increasing since 1989.

In other words, people who have a bachelor’s degree are 82% more employed than they were in 1989 and people who have a high school diploma or less are 14% less employed than they were in the not too distant past.

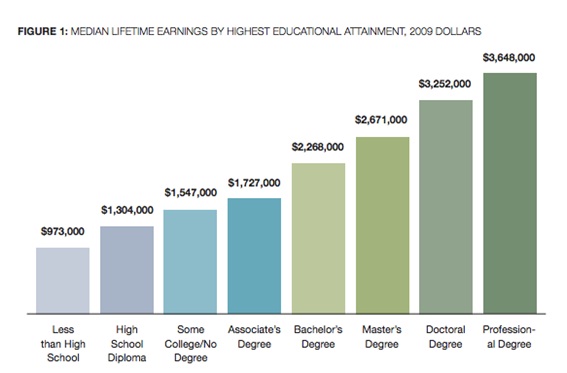

Speaking in terms of differences in lifetime earnings, another August 2011 report by Georgetown University’s Public Policy Institute Center on Education and the Workforce (the same institute as the previous report from Georgetown University), shows just how much the college degree pays off in the long run.

The report titled, “The College Payout: Educations, Occupations, Lifetime Earnings” states that someone who lacks even a high school diploma will make a median $973,000 over the course of his/her lifetime whereas, on the polar opposite end, someone who earns a Professional Degree will earn, on median, $3,648,000 over the course of his/her lifetime. A complete graph is below for more details.

From this graph above, one can see that even earning a bachelor’s degree alone increases your lifetime earnings over someone who simply earns a high school diploma by nearly $1,000,000.

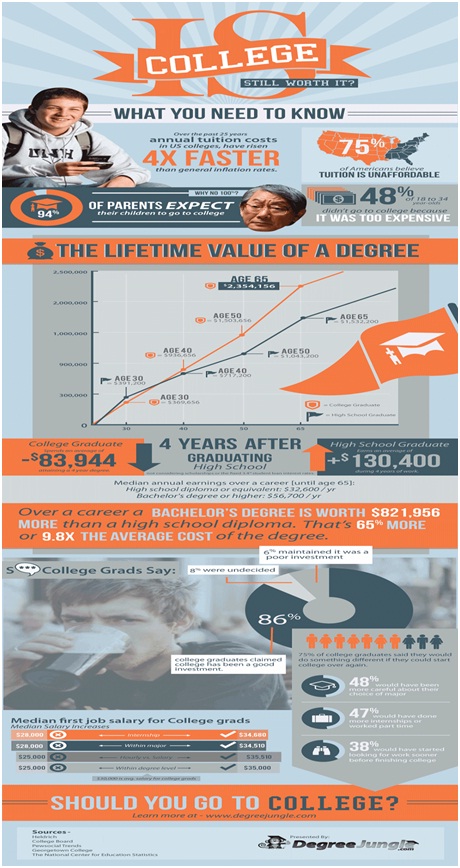

A nice infographic from DegreeJungle.com, a website created in 2010 to help prospective students research online universities, not only illustrates the lifetime benefits in a new way, but also includes a lot of other neat information (instead of splitting up the different levels on collegiate degrees like the aforementioned graph, this infographic groups all college graduates together – no matter what the degree type).

Of course, though, people will note that your lifetime earnings largely depend on the major. As noted by ZTCollege.com’s Blake Boles, a petroleum engineering or chemical engineering major has a good chance of earning $100,000-$150,000 mid-way in a career whereas a child and family studies or social work major might earn approximately $40,000. Better yet, an entire list of majors and their corresponding mid-career salaries can be viewed here.

So, it’s not really in simply attaining a degree; it’s really where one decides to focus or major.

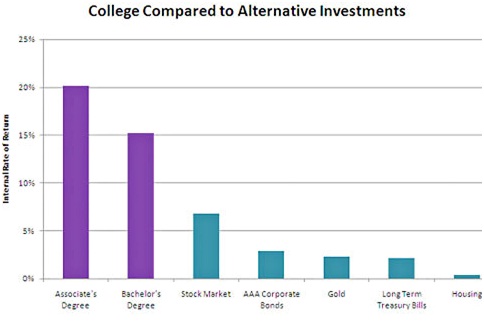

But what’s also interesting is to compare college as an investment to other investments. As shown in Catherine Rampell’s article in the New York Times, an investment in an associate’s or bachelor’s degree will have a greater return than the stock market, AAA corporate bonds, gold, long term Treasury bills and housing, according to the Hamilton Project data. That’s right: investing in college is better – a lot better in fact (look at the graph) – than investing in gold.

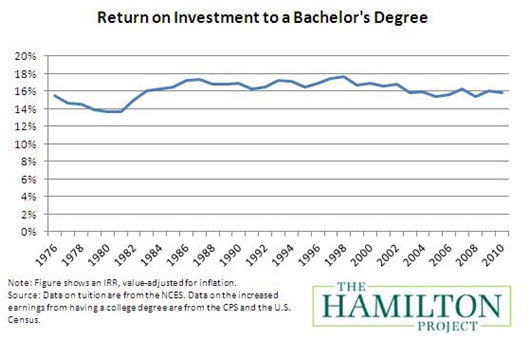

The Hamilton project also created a graph depicting the return on investment for a bachelor’s degree over time. Clearly, even though the sticker tag on a college education has gone up, the return has hovered around 16% from 1984 until present day.

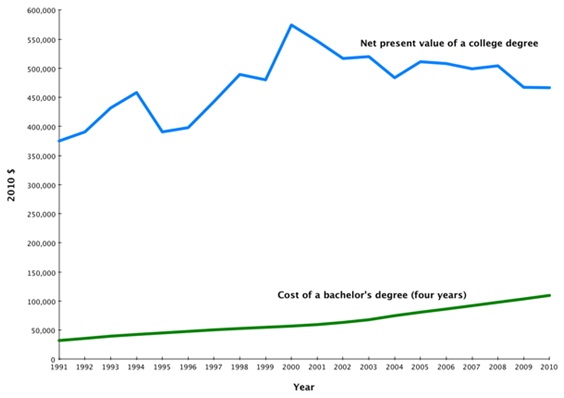

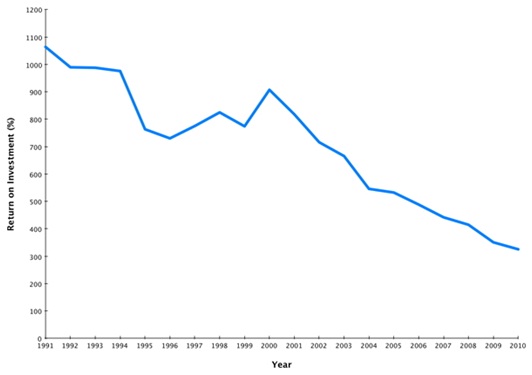

While the above Hamilton Project presents one case, two graphs from the Washington Post show a different picture. Indeed, the Washington Post’s graph show that the value of a bachelor’s degree is decreasing – and has been decreasing – for some time.

From above, one can clearly see how, while earning a Bachelor’s degree in college still has a three-fold investment return, the return has been rather rapidly decreasing since 1991 (the earliest data on the chart above.)

New Approach: Paying Students to Skip College

According to Stasticbrain.com, PayPal conducts over $315 million in business every single day, representing an astounding 18% of the total ecommerce transactions. With over 106 million active PayPal accounts, 25 currencies and $3.4 billion in total revenue in 2010, PayPal is the world’s leader in facilitating intercontinental commerce in the digital age, and the founder, Peter Thiel, now a prominent Silicon Valley venture capitalist, has created a “20 under 20” program that seeks talented and gifted students to skip a college education altogether. It’s an attempt to both give young entrepreneurs an alternative path and take a more “hands-on” approach.

In an interesting piece by Deborah Cohen for Reuters, Dale Stephens, who was homeschooled grades 6 through 12, describes how he just couldn’t resist getting $100,000 from Thiel to start a start-up. With the money, Stephens has created UnCollege, a website that provides users with resources that promote taking an alternate path: bypassing college. Stephens also plans to release his first book “Hacking Your Education: Ditch the Lectures, Save Tens of Thousands, and Learn More Than Your Peers Ever Will” on March 5, 2013.

Thiel, who ironically took a very standard path (he earned both his degrees from Stanford University), “has argued the U.S. needs to jumpstart technology innovation and investment.”

So far, the project certainly looks intriguing as the two-year fellows are running projects that range from decentralizing banking to extracting minerals from asteroids.

Concluding Remarks

Though projects like “20 under 20” are on track to make a dent in the universe, as Steve Jobs would say, earning a bachelor’s degree is not only worth the ending financially but also much more conservative and “safer.” Even if people like Bill Gates and Steve jobs among others have shown that college isn’t necessary, not everyone can start a successful startup without attending college and earning a bachelor’s degree.

That taken into account, I feel that we can take a lot away from the “UnCollege” movement. Specifically, I believe that higher-level learning must focus more on entrepreneurship and real-world applications and less on the pedantic memorization-based approach. After all, our innovators weren’t driven by sheer memorization; they were driven by a spirit and concept.

Taken together, college is worth it for some and not as much for others. For the “wanna-be” doctor, physicist, engineer, college is not just worth it – it is required. For the “wanna-be” tiler, plumber, mail courier, etc., saving money by earning an Associate’s degree or attending a vocational school will be well worth it.

Go to college, but try to do something extraordinary in the process.