Background

Born in 1944, Lynch grew up in a middle-class family in Newton, Massachusetts. At the age of 10, Lynch’s father passed away from brain cancer. Due to this, Lynch’s mother had to take a larger role as a supporter for the family. This had a lasting impact on Lynch’s life as he witnessed firsthand her strong work ethic. After getting a job as a caddie at his local golf club, he developed a particular liking to the stock market. This interest was fostered due to his exposure to countless businessmen on the golf course. He listened closely to conversations between wealthy individuals talking about the market.

After working hard all throughout high school, he earned a scholarship to Boston College where he studied history, psychology, and philosophy. Lynch believes his study in these subjects did better for his investment career than any business course. Philosophy taught him how to think critically and originally; psychology taught him the way people think, which he used in understanding market psychology; history gave him a contextual knowledge of recurring cycles in human history that translate to the market. Lynch argued that while business classes are valuable for learning specific financial concepts and tools, the ability to think critically, understand human behavior, and see the broader picture was what truly set him apart as an investor.

After graduating from Boston College, Lynch attended the prestigious Wharton Business School at the University of Pennsylvania, where he got his MBA. Following college, he took over the Fidelity Magellan Fund in 1977 at 33. At the time, the fund was relatively small, with $18 million in assets. Over 13 years, he grew it to $14 billion while achieving extraordinary returns.

After retiring from the fund in 1990, he stayed involved in the world of investing in numerous ways. One of, and the most important of those ways was his philanthropic endeavors following his retirement. He was deeply involved in charitable work through the Peter Lynch foundation, donating to medical research, children’s health, and education.

Investment Philosophy

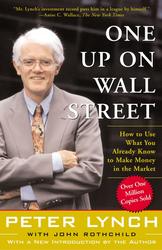

Lynch’s investment philosophy parallels those of Warren Buffett and Benjamin Graham, collectively known for their focus on value investing. In One Up on Wall Street, Peter Lynch breaks up his investment analysis into three steps.

1. Preparing to Invest

Lynch, in Part I of “One Up On Wall Street,” lays the foundation for his investment practices before investing in a company. One important aspect he covers is the power of a common person over the professionals. He tells a story of how he found a high return investment in Hanes because of his wife, Carolyn, going through her daily life. “Carolyn didn’t need to be a textile analyst to realize that L’eggs was a superior product,” wrote Lynch, highlighting the importance of looking beyond Wall Street for an investment. There are a plethora of companies he found through this method such as Taco Bell, La Quinta Inns & Suites, and Dunkin Donuts.

Most importantly, this part is stressing an individual’s mindset as an investor. He stresses the importance of being original in your thought. Today, it’s very easy to follow the crowd and get caught up in what Wall Street is doing, but often times, its not always the right thing. There is a need to set aside emotion and just use logic. Sometimes it is hard to set aside emotion, as you are putting your money on the line, but if you study the market diligently and keep to your findings, you will be a successful investor.

2. Picking Winners

In part II, Lynch emphasizes using your common sense to find a successful investment. He, again, talks about the necessity to just go out to your local shopping mall and using your common sense to deduct what is going on in the business world. This form of research allows you to “discover potentially successful companies before professional analysts do,” as mentioned in One Up on Wall Street. Once Wall Street gets a hold of an investment, then it is already too late. Many people see stocks that are reaching all time highs on the news, and decide to invest in them just because of the hype surrounding them. Lynch says that this is a huge issue when people are picking stocks.

“All you have to do is put as much effort into picking your stocks as you do into buying groceries.” -Lynch

Most importantly, Lynch talks about the need to understand a company’s story. Understanding a company’s story is a lot easier if it’s a simple company. He would rather invest in a company that’s selling something simple such as motel chains rather than fiber optics. This makes it easier to research and understand. He advises against investing in a company if you cannot understand how they make money. He also says to look for a company that’s so good, even an idiot could run it. A company may be under good leadership now, but in a couple years that might change.

Before investing, he also categorizes a company into six categories: the slow growers, the stalwarts, the fast growers, the cyclicals, turnarounds, and the asset plays. Categorizing these companies allow you to loosely understand their behavior, and better analyze it. Most importantly, it simplifies the investment process, which is necessary because every investor’s enemy is complexity. Overall, he has many other practices he uses, but these are the ones he emphasizes the most.

3. The Long-Term View

In part III, he talks about designing a portfolio, when to buy and sell, and some investor misconceptions. Lynch writes that it is necessary to not have too high of expectations. This idea goes back to investors psychology. Some years you will lose 30% and other years you will gain 30%.

One of Lynch’s strongest beliefs is against diversification, or what he calls “diworsification.” The common investor should only be invested in 10-20 well-researched stocks. He still, however, believes that the investor should invest in a few different categories. This will mitigate downside risk, but when a portfolio becomes too diversified, it loses out on potential upside as well. The best way to minimize risk in an investment is to actually know the company. If you research it and do not find anything suggesting a bad investment, then that’s basically all the risk management you need.

Lynch makes it obvious he knows that he cannot predict the market and know exactly when to buy and sell. Nevertheless, he gives two examples in One Up on Wall Street when it is a good idea to buy. One example is the end-of-the-year tax selling, which is a period in which investors and institutions sell losing stocks to offset capital gains for tax purposes. These often lead to artificially low stock prices at the end of the year, creating buying opportunities for smart investors. The other time he says to buy is during market freefalls. This is an event that occurs every few years that sends the average investor into panic. This is an important time to keep cool, stick to your logic, and look for undervalued companies.

Conclusion

Peter Lynch’s legacy as an investor is defined by his remarkable track record, disciplined approach, and emphasis on common-sense investing. His philosophy, as outlined in One Up on Wall Street, demonstrates that successful investing is not limited to the professionals. Anyone willing to observe the world around them, think independently, and conduct thorough research can achieve strong returns. Despite his relatively short tenure in fund management, Lynch’s impact endures through his teachings, philanthropy, and influence on countless investors. His insights serve as a timeless guide for those looking to navigate the stock market with confidence and clarity.

Stay tuned to The Roundup for more historical profiles!