Austin Kimson, Chief Economist at Bain & Company, talked to the investment club during community time on September 23, 2024. He spoke on his journey as an economist and how we can use macroeconomics to our advantage while investing in the stock market, all while rocking a glorious mustache.

Early Life & Career

As a kid Austin, wanting to take after his dad, and thought he wanted to be an engineer, but at the age of 14, he knew exactly what he wanted to do. Starting out, he gambled his parents money on day trading, which he soon found to be unsuccessful. A few years later, he studied economics at Brown University. He prided himself on taking a variety of different classes that widened his knowledge of economics, graduating in 2001. After graduating, there was a massive crash in technology stocks, so he looked for a recession-proof job, leading him to the federal reserve bank in San Francisco, California. Although gaining much experience working at the federal reserve, he became bored of the “fed life.” So, three years later, he hopped over to the Bain Silicon Valley office, eventually transferring to the Dallas office, having no interest in the Bay Area.

Economics in the Stock Market

“If you understand the macro-environment well, that is additional leverage.” -Austin Kimson

Understanding only the economy when investing certainly wont give you all the answers, but it can be a massive player in how a stock changes. Austin’s economic philosophy, gained from working at the federal reserve, is that you need to look for signs of “stress and cracking” in the economy. Some things that can indicate these stressors include rising unemployment, inflation, liquidity problems, or weakening consumer confidence. Another thing to consider is to look back 12-18 months at the relevant monetary policy, and how it is effecting growth today. Throughout history, the economy has held true to recurring patterns, so Austin advises to look back and use the examples of the past, to not fall victim to the market hype.

“The last words of every economist is ‘this time is different.'” -Austin Kimson

Utilizing Macroeconomics in Investments

Usually when analyzing a company, things like its financials and financial ratios are reviewed to determine its individual growth potential. However, to build a more robust investment thesis, one must widen their view. Rather than solely focusing on a company, you must understand the market trends, which are understood through analysis of the current economy. One might assume this means being bullish when the market is up and bearish when the market is down. This is a common misconception that is due to investing with emotion. Nathan Rothschild, said “the time to buy is when there’s blood in the streets,” Warren Buffett said “to be fearful when others are greedy and to be greedy only when others are fearful,” and the list goes on.

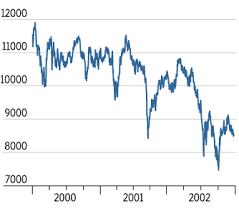

The chart displays the US Economy (GDP) vs. the US Stock Market (S&P 500). As shown, the economy and the market are not exactly correlated; in fact, in most cases, the economy follows the market with at least a month lag. This is because markets are forward-looking, reflecting investor expectations before economic data catches up. So, usually the market has already began recovering by the time the economy reaches it’s low.

Now with this information you must be thinking, “well what do I do with this?” Due to the economy’s lag, it is safe to assume that once the economy reaches its low, the market is on its recovery, deeming it a relatively safe economic environment to invest in.

Conclusion

Overall the wide range of guest speakers and talks that the investment club has scheduled throughout the year can be very beneficial to learning more about a future in finance or economics, and also teaching you how to be an effective investor. In order to most efficiently grow your wealth you must be able to learn to be an effective investor, rather letting your money sit in a bank. If you have an interest in learning more about these sorts of things, tune in to the next investment club meeting.