On April 2nd, 2025, the world witnessed something never seen before: universal tariffs on nearly every country and territory. Trump’s Liberation Day plan promised an initial 10% baseline tariff on all imports, followed by “reciprocal tariffs,” nation-specific, tariffs to balance bilateral trade deficits. Trump enforced reciprocal tariffs on approximately 60 countries and territories who were deemed to partake in unfair trade practices.

From Trump’s controversial tariff policy emerges a global trade war, with the U.S. seemingly isolated. Businesses struggle to maintain profit margins as the cost of foreign goods increases, forcing them to drive up prices. The U.S. stock market loses more than 5 trillion USD in a mere 2 days following the Liberation Day announcement. Consumer confidence plummets and individuals’ financial portfolios sink in a fear-induced bloodbath. But was the selloff irrational? Is this the apex, or a capitalizable bottom? Should you be buying in this turbulent market?

Background

On April 9th, Liberation Day’s execution, Vietnam saw a 46% tariff, increased from a previous 0-5% on select electronics and apparel. The EU saw a 20% tariff, increased from a previous, rough 2.4% on select goods, and more crucially, China saw a 54% combined tariff, increased from a previous 2-4%, that most recently escalated to a colossal 145%. These represent only a few critical examples, with other severe examples abroad, including the semiconductor superpower Taiwan, technology and automobile giant Japan, and mineral supplier Brazil.

Tariffs and the Selloff

So what is a tariff, and how do Trump’s tariffs work?

A tariff is a tax imposed by a government on imported goods, with the intention of influencing trade or generating revenue. Donald Trump’s specific intent behind Liberation Day appears as follows: Destabilizing the Chinese economy by driving the selling of U.S. 10y treasuries, inciting a war against the domestic deindustrialization crisis, and curiously, acting as a negotiating tactic. Most emphasized by Trump during his White House Rose Garden speech however, was the motive to stop other nations from “ripping us off.” Trump declares during his speech, that “for decades, our country has been looted, pillaged, and plundered by nations near and far, both friend and foe alike.”

While the Liberation Day proposal presents itself convincing and visionary, the solutions aim for chancy, long-term goals at the expense of the short-term.

The Consequences of Liberation Day

By imposing tariffs on imports from another country, the exporting country’s goods become more expensive for domestic buyers. As a result, U.S. companies must pay higher prices to import foreign goods. For example, an Apple iPhone that previously cost $100 to import from China might now cost around $240, reflecting the added tariff costs. Now Apple faces a dilemma: should they take the blow to their profit margin, or should they charge consumers more for an iPhone? If the profit margin weakens, the net income will appear unattractive to investors, and the company will struggle to stay afloat with less cash. If they charge consumers more for an iPhone, less people will buy the new, glamorous iPhone, reflecting on their revenue, and thus also appearing unattractive to investors.

While some U.S. industries can readily pivot to a domestic alternative for manufacturing, others cannot. For instance, in the U.S. semiconductor industry, your NVIDIAs and AMDs, cannot function without the Dutch company, ASML to produce photolithography machines, essential in the production of chips. And at that, they would struggle greatly to rebalance their supply chain due to their almost exclusive reliance on Taiwan Semiconductor, who manufactures their chip designs. Even if they do make the shift to domestic manufacturing, the intense cost of transitioning, and the increased labor costs will massively upset their income statement.

Because individual companies will struggle to survive and generate revenue, investors will reassess valuations, and the economy as a whole will slow down. So was the selloff justified? In my opinion, yes. If the tariffs remain in place, the economy is likely to experience some resistance, which could frighten investors concerned about both corporate and broader macroeconomic growth. But we have yet to actually witness the impacts of the tariffs. So why is the market crashing? Will it continue to fall as the real effects materialize? What does this say about the market?

The Nature of the Market

The Market Looks Forward

George Soros, a legendary hedge fund manager, says in The Alchemy of Finance, “Financial markets constantly anticipate events, both on the positive and on the negative side, which fail to materialize exactly because they have been anticipated.” In other words, markets anticipate events, they do not wait for them to happen. If Johnson & Johnson announces they will unveil the cure to cancer in 30 days time, investors will relentlessly buy the day of the announcement, rather than the day the company releases the cure.

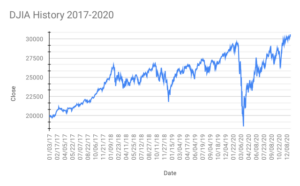

Take for instance, in late February, 2020, the infamous Coronavirus Crash. The crash depletes the U.S. stock market of nearly 1.7 trillion USD, and investors panic, foreseeing the macabre effects to take place. Despite no immediate crippling economic consequences taking place, the Dow lost 37% of its value from February 12th to March 23d. Investors witnessed their retirement savings accounts dropping around 30%. The surprising part? The stock market bottomed an entire year and a month before earnings! In October 2020, Carnival Cruise reported an astounding drop in revenue, from $6.53 billion during Q3, 2019, to $31 million in Q3 2020, a 99.5% decrease. The stock fell 2% that day. Why? The stock had already reacted during the Coronavirus Crash! The initial crash already forecasted the revenues of the company! The market does not wait for bad news to bottom.

Application

This same logic applies to the current market crash; The market has already taken into consideration the extended effects of the tariffs, and realizes the probability of economic downturn.

This behavior is not to say we have hit a bottom. In fact, likely, we will see the market dip more over the next few days or weeks. But am I buying? Yes. Yes I am. This brings me to my second point: The declining market acts as a negative-sum game for the fearful.

The Market Punishes a Fearful Investor

The actions of the fearful during a market crash can be dissected into 3 parts. A. They sell when the market enters fear, and declines rapidly, hoping for an entry point at a cheaper price. B. As the market continues to fall, they lose confidence, less likely to make an entry. C. They miss the bottom, the market rebounds rapidly, and they must buy back what they had sold at a higher price, losing money.

Referring back to the Coronavirus Crash, following the bloodshed from February 12th to March 23d, the stock market finally sees a beaming light. The fourth best day in stock market history, March 24th, 2020, marks the beginning of a relentless comeback. Only those who bought during the tumult of earnings threats and monetary policy struggles enjoyed the stunning, 11.4% increase, and the bull market that followed.

But what did the fearful investor see? Since they had reacted to the initial decrease, they sold at a loss, then, greedy to time the market, missed the monumental rebound.

Warren Buffett famously said that it’s wise for investors to “be fearful when others are greedy, and to be greedy when others are fearful,” a contradiction to human instinct, but a timeless pointer to be successful in the market. This advice stems from the idea that emotional investors push the market further than correction. When fearful investors sell at a loss, they drive the market down further, below the discounted, rational levels, and make the market look even more attractive.

The Current Market & Evaluation

The investor sentiment, Fear and Greed Index index lurks deep in the “Extreme Fear” category. The VIX volatility index sees levels similar to the 2008 financial crisis, and the Coronavirus Crash of 2020. The stock market has already seen a steep decline. Now, in my opinion, there exists a great buying opportunity. The market has already priced in the tariff-related downside, and excessive emotional selling continues to make for a better and better deal.

I do not intend on predicting the bottom of this crash, nor do I know the immediate future. However, barring unexpected escalation, or any other catastrophic events to the market, I can assure you that a rebound sees itself around the corner. Still exercise caution as Trump’s stance on his tariffs rapidly changes from tweet to tweet.

In Conclusion

While the Liberation Day tariffs present real and extreme challenges to the economy, the market’s sharp decline ultimately reflects its forward-looking nature, not a delayed panic. And with a discounting of the long-term effects, as well as an additional fearful selloff, we find ourselves a prime entry into the market. History testifies that markets punish fear, and reward firm conviction; Investors’ actions, whether they sell into chaos, or embrace rationality in the face of uncertainty, will ultimately discern the losers from those who build lasting wealth. This storm may not be over, but the seeds of the next bull market lay in the soil of fear.

Stay tuned to the Roundup for more finance articles!