On April 2nd, 2025, Donald Trump announced he would be placing reciprocal tariffs on majority of the countries in the world. This plan especially seems to have polarized reactions by both sides. Does he have an ultimate goal, or are we looking down the barrel of a recession?

Trump’s Plan

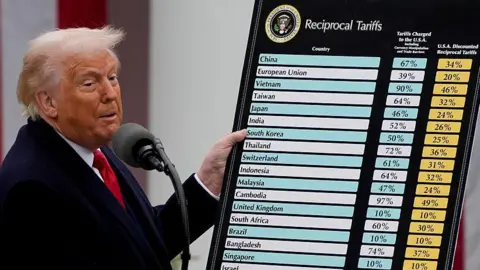

On The White House website it says that the US would impose a 10% tariff on every country. Furthermore, impose a larger tariff on countries the United States has the largest trade deficits with. Goods such as steel/aluminum, auto/auto parts, copper, pharmaceuticals, semiconductors, energy, and other certain minerals that are not available in the United States will be excluded from the reciprocal tariffs.

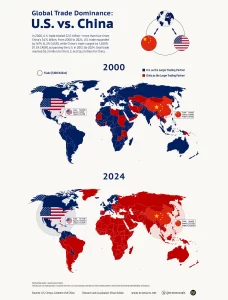

There are 2 things Trump plans to get out of these tariffs, as stated on the White House website: strengthen the international economic position of the US and protect American workers. Following the second world war no country came close to the manufacturing power of the US. Focusing more on other sectors of the economy, the US lost its domination. The gap between the United States and the rest of the world not only narrowed, but China overtook the number one spot. Many companies move their manufacturing to China due to cheap labor. One advantage of the US over other countries, is our immense consumerism. Entire businesses and country’s economies are based on selling to America. Trump wishes to use this advantage to bring manufacturing back to the US, because no company wants to lose its greatest consumer.

There is one thing that goes unmentioned by Trump and why he is imposing such aggressive tariffs. Tariffs at surface value are inflationatory, increasing the cost of goods, but when trade war erupts and supply chains are disrupted there may be a slowdown in economic growth. Before you call him crazy for purposefully crashing the economy, there is possible long-term benefit from this. With a stagnant or deflationary economy the Federal Reserve lowers rates. With the lower rates loans become cheaper for businesses, mortgages, and car loans, benefitting the consumer and further incentivising businesses to move to the US. Moreover, it gives the government an opportunity to reduce the US national debt.

Downsides

Trump’s plan has sent shockwaves throughout the world’s markets in the few days the tariffs have been in effect. In the past century, most every country looked to the United States for support. With these tariffs destabilizing many economies, these countries may stop looking towards the United States for support. These tariffs, along with other of Trump’s policies, seek further US isolation and autonomy. The last time the United States adopted such isolationist policies, we saw the birth of fascist totalitarianism governments in western europe and around the world. It is true that domestic issues should be prioritized, but when foreign issues go unchecked, they have potential to become domestic issues.

Another dilema to Trump’s economic plan is his unusual departure from the traditional Republican ideal of free market economics. This plan requires heavy government intervention to influence economic outcome. It’s quite ironic, with a few exceptions, that the left is mostly against it and the right is mostly for it. It also serves as further evidence of loyalty towards parties and not towards policy. There is no perfect plan and there is always downside, so these plans must be looked at wholistically and bipartisanly.

Fear, Greed, and Opportunity

Following the implementation of the tariffs, the market plummeted to almost a yearly low. This reaction to the tariffs led almost every stock in America to fall to insanely low prices. Some argue this fall was much needed, as the market in the past year was arguably overvalued and possibly even going towards a bubble.

“Be fearful when others are greedy and to be greedy only when others are fearful” – Warren Buffett

Being the biggest holder in the equity market, the richest in America took a large blow. Numerous billionaires lost billions of dollars in the month of March, except Buffett. Buffett has been liquidating his assets in the past few months and preparing for an event such as this. I bet in the coming weeks/months when the markets are at all time lows, he will be buying up stock like it’s on clearance. If you wish to be the best, do as the best do. In this case, follow Buffet’s famous quote.

There is also a big misconception that buying now is a terrible idea because of the possibility of a continuing falling market. There is definitely a possibility it does continue to fall, but there is also a possibility the market recovers. Never try to time the market’s bottom or peak. It is much more feasible to determine how over/undervalued a company is when devising an investment plan. Right now many companies are trading below their intrinsic value and it is an amazing opportunity to buy.