Dream job or corporate nightmare? Investment banking is the goal for most finance enthusiasts, but is it really worth it? I will lay out the facts, and you can determine if investment banking is for you.

What is Investment Banking?

Being an investment banker entails guiding companies through many financial decisions. One of those being Initial Public Offerings (IPO), a process in which a company transitions from a private to a public company, and offers shares to the public. Another example being Seasoned Equity Offerings (SEO), which an already public company issues more stocks, like a follow-up of the IPO. The common goal of all these offerings is to raise capital for a company or even the government.

The Job Description

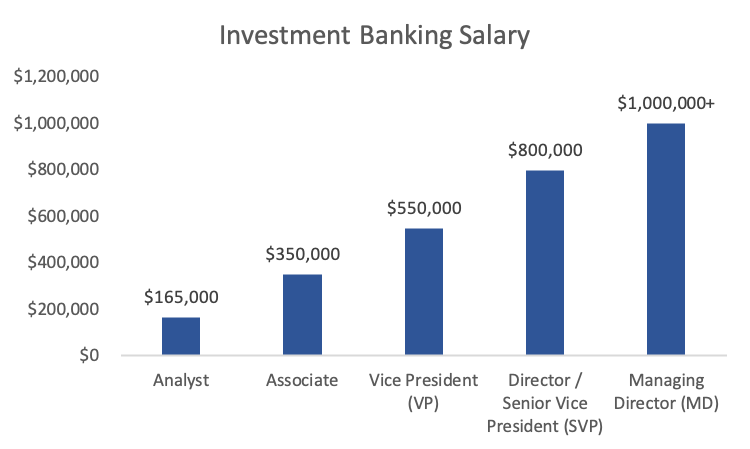

The average Patagonia vest wearing investment banker has an incredible amount of obligations throughout the day. One of these tasks include analyzing the financial market, a grueling task that covers a wide array of economic scenarios. The main task is accessing a company’s debt, and determining whether there are any ways of increasing profit, benefitting the shareholder. Being assigned presentations up the wazoo and out of the blue is common. Although it is a fast-paced, stressful job, the starting salary is upward of six figures. Being able to secure a six figure job right out of college is a dream of most. The average salary for a recent college graduate is $55,260, while the average first year financial analyst on Wall Street makes $165,000. The profound salary is what makes it a highly sought after position. In 2022, there were a total of 236,000 applicants for 3,000 positions at Goldman Sachs, just a 1% acceptance rate!

The Illusion of Success

Although a job in investment banking grants a great salary, there is a slight catch. Many jobs require serious focus and grit, but none rival investment banking. This stressful process of investment banking starts long before a job is even granted while applying for internship, starting sophomore year of college. Then, there is a highly competitive process in which the top firms primarily only pick those candidates from target schools such as UPenn and Princeton. The applicants then go through a process of multiple interviews where their financial knowledge is tested immensely. Even once your accepted, don’t expect it to get any easier. The average investment banker works on average 80 to 100 hours. Even beyond the workplace, bankers are receiving hundreds of calls and emails throughout the day. The job requires so much demand and energy, its not uncommon that it takes away from other aspects of ones life.

Conclusion

Conclusion

Ultimately, being an investment banker has many pros and cons, much more than I’ve concisely highlighted. It comes down to the wants and needs of you. If you highly value free time, a diverse life, and believe money doesn’t achieve happiness, than investment banking is probably not for you. If your ultimate goal is financial success early by sacrificing your social life then it probably is for you. There are many successful finance positions beyond investment banking that pay well and require less demand, such as private equity, quantitative finance, and real estate. Like any other big decision it’s always important to discern and research whether its the right choice for you.